Deep understanding of global systems

Paradigm shifts in global production and economic systems—driven by technological advancements and evolving consumer behavior—are reshaping industry dynamics in Latin America’s growth markets. Our expertise in key systems like the Energy Transition, Circular Economy, and Conservation enables us to navigate uncertainty and uncover opportunities for transformative change and value creation in the region.

Regional expertise

With over 30 years of experience across industries in Latin America, we combine a deep regional footprint, local insights, and an extensive network of family offices and institutional investors. This allows us to directly source proprietary investment opportunities and build a unique deal pipeline beyond competitive processes.

Long-term investment horizon

We partner with investors and business owners who prioritize sustainable, long-term value creation over short-term gains. Our investment vehicles are structured with robust governance to support the deployment of patient capital for enduring growth.

INVESTMENT THEMES

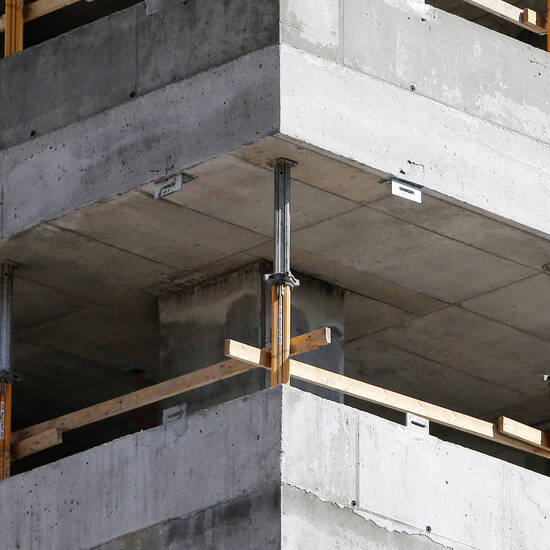

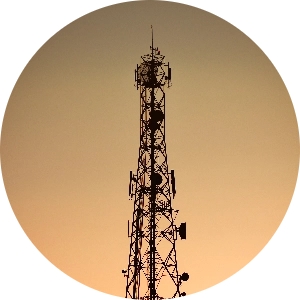

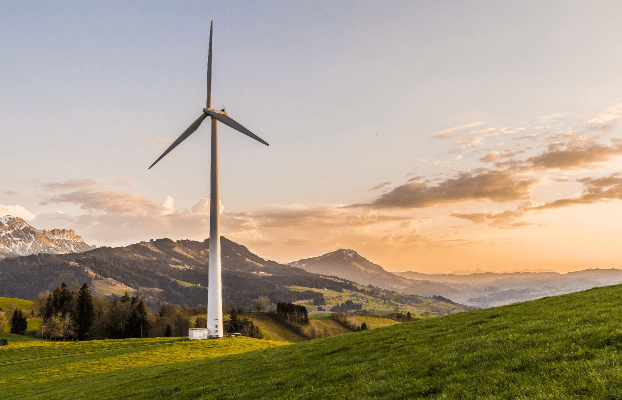

Energy Transition

Distributed power generation, storage, microgrids, electric mobility, energy efficiency and green hydrogen

Circular Economy

Industrial waste management, plastic recycling, material and chemical reuse, waste disposal, water treatment and reuse, as well as biomass and agrowaste solutions.

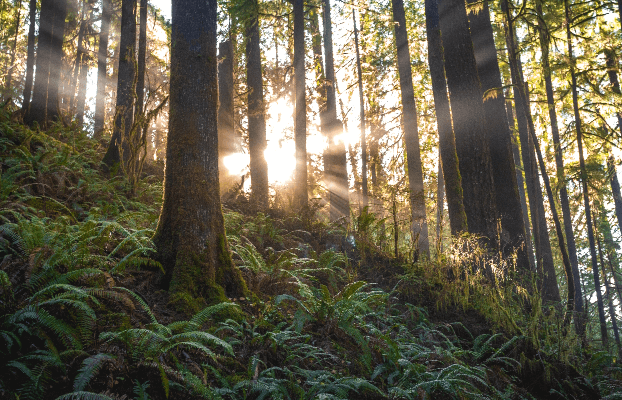

Conservation

Natural capital management, biodiversity conservation and protection, forest regeneration, ocean preservation, and greenhouse gas capture.

Innovation and sustainability

Sustainability lies at the heart of our approach to innovation, competitiveness, and value creation. We ensure our portfolio companies embrace a triple-bottom-line philosophy, balancing financial, social, and environmental impact, while generating value for all stakeholders.

Long-term partnership

We strive to be the trusted partner of choice for businesses, collaborating closely with existing owners. Our governance and incentive structures encourage local participation, as desired, while providing strategic insights, relationships, patient capital, and inspiration. This approach reignites a founder’s mindset and motivates management teams to achieve exponential growth.

World-class talent and leadership

We leverage access to world-class expertise and are committed to complementing management teams with top-tier talent and executives. By fostering a culture of conscious leadership, we empower both our portfolio companies and our firm to achieve excellence.

Governance

We help our partners implement best-in-class governance practices, building strong foundations and structures to support sustained growth and long-term success.

Strategic planning and operational excellence

With deep roots in consulting and investment banking, we deliver strategic and operational value through long-term planning, enhanced management practices, and robust corporate governance. Our unique methodology combines rigorous analysis with creativity to uncover growth opportunities and drive performance.

Transformational ecosystem

Our extensive partnerships with local and global stakeholders form a dynamic ecosystem centered on our key investment themes. This network generates exceptional value for our portfolio companies by fostering collaboration and innovation.