Deep understanding of global systems

Paradigm shifts in the global production and economic system, largely driven by technological disruption and changes in consumer behaviors, are leading to new industry dynamics in Latin American growth markets. Our deep understanding of these systems (ie.Energy Transition, Circular Economy, Conservation), and how they play out in Latin America, allows us to cut through uncertainty and identify opportunities for industry transformation and value creation.

Regional expertise

We leverage our +25-year experience working with companies across industries, regional footprint, local insight, and access to a broad network of family offices and institutional investors, to identify potential partners directly, originating a unique deal pipeline of proprietary investment opportunities outside of competitive processes.

Long-term investment horizon

We partner with investors and business owners that prioritize long-term value creation over short-term earnings. Our investment vehicles are designed with a governance structure that enable the deployment of patient capital.

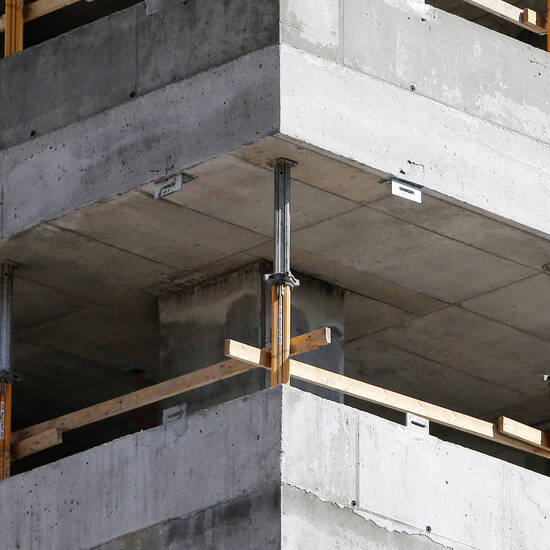

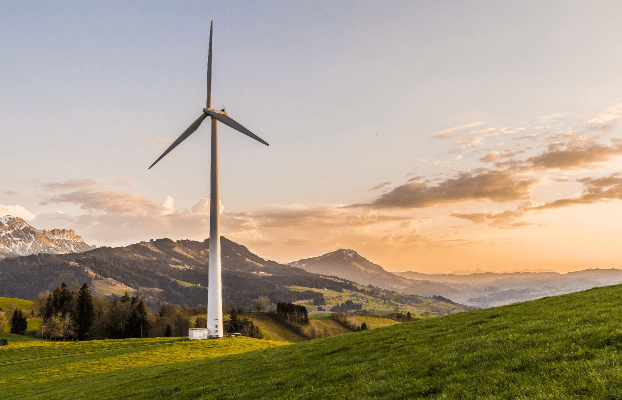

INVESTMENT THEMES

Energy Transition

Distributed power generation, storage, microgrids, electric mobility, energy efficiency and green hydrogen

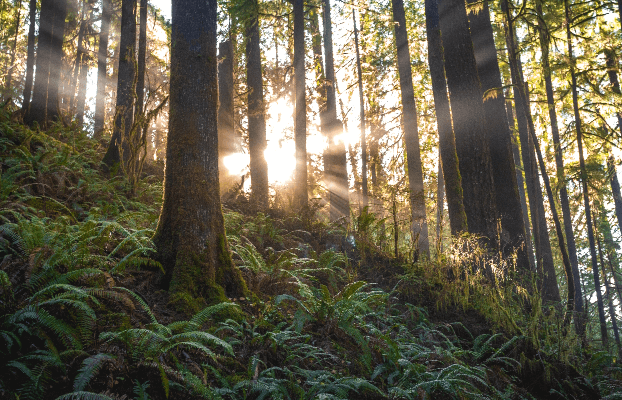

Circular Economy

Industrial waste, plastic recycling, material and chemical reuse, waste management, garbage management, and water treatment and reuse

Conservation

Management of natural capital, conservation and protection of biodiversity, regeneration of forests, protection of the oceans, capture of greenhouse gases

Innovation and sustainability

We believe in sustainability as a core driver of innovation, competitiveness and value generation. Our portfolio companies are prepared for the adoption of a triple-bottom-line philosophy and reporting system that ensure the generation of value for all stakeholders

Long-term partnership

We aspire to be the ally of choice for businesses and prefer to work closely with existing owners. We constitute a governance and incentives structure that facilitates participation of local partners to the extent desired, and provide the insight, strategic relationships, patient capital, and inspiration needed to re-ignite a founder’s mentality and motivate management teams in companies, to create exponential value.

World-class talent and leadership

We have access to world-class knowledge and insight, and continuously look to complement existing management teams with A-level talent and executives. We foster a culture of conscious leadership in our portfolio companies and within our firm.

Governance

We support our partners in the establishment of best-in-class governance practices which provide the adequate structure and foundations to drive continuous growth.

Strategic planning and operational excellence

The Firm’s deep consulting and investment banking heritage drives strategic and operational value creation through the design of long term strategy, strengthened management, and improved corporate governance practices. Our unique approach combines rigorous analysis with creativity and innovation to identify opportunities to drive growth.

Transformational ecosystem

Through our partnerships and alliances with a wide-reaching base of local and global stakeholders, we have built an ecosystem of actors around our key investing themes which generates value for our portfolio companies.